Your credit union is humming, phones are ringing non-stop, members are lining up at the counter and your team is frantically searching for answers to multiple questions.

This is happening in credit unions all over the world and it presents a problem: providing personalized, accurate information fast while being compliant and building member trust.

But what if we told you there was a way to turn this chaos into calm? A solution that could transform your credit union into a well-oiled machine, where information flows smoothly, your staff is confident, and members are happier than ever?

That solution comes in the form of knowledge-based software.

In this guide, we’ll look at how knowledge-based software and knowledge management can transform your credit union’s operations, communication, and customer service.

Why Credit Unions Need a Knowledge Base

Apart from being a single source of truth, a knowledge base is a strategic asset that can drive your credit union forward. By centralizing information and making it easily available you can:

Empower Your Staff

By implementing knowledge management and making use of knowledge-based software, credit unions can equip their teams with the tools they need to provide accurate and consistent information to members.

A well-organized knowledge base reduces reliance on manual processes and frees up staff to focus on higher-value tasks.

Centralize Information

Make it easy for your members and create a world where every piece of information – from loan policies to service protocols – lives in one easily accessible place. That's the power of a centralized knowledge base.

There’s no need to go digging through dusty manuals or getting lost in endless email chains. With a knowledge base, your team can find what they need in seconds, not minutes or hours.

This centralization doesn't just save time; it ensures consistency. When everyone's working from the same playbook, you minimize errors and miscommunication.

Empowering Employees

Remember the anxiety of your first day on the job? The fear of not knowing enough? A robust knowledge base turns every employee into an instant expert.

New hires can quickly get up to speed, reducing training time and boosting confidence. Seasoned staff have a reliable backup for those tricky questions that pop up once in a blue moon.

This empowerment leads to more than just efficiency – it breeds innovation. When employees aren't bombarded by routine queries, they have more mental space to think creatively and solve problems.

Improve Member Service

Did you know that 81% of all customers attempt to take care of themselves before reaching out to a live representative?

In the competitive world of financial services, member experience is everything. A knowledge base enables your front-line staff to provide quick, accurate answers to member queries.

No more "Let me check with my supervisor" or "I'll have to call you back." This efficiency not only impresses members but also builds trust and loyalty.

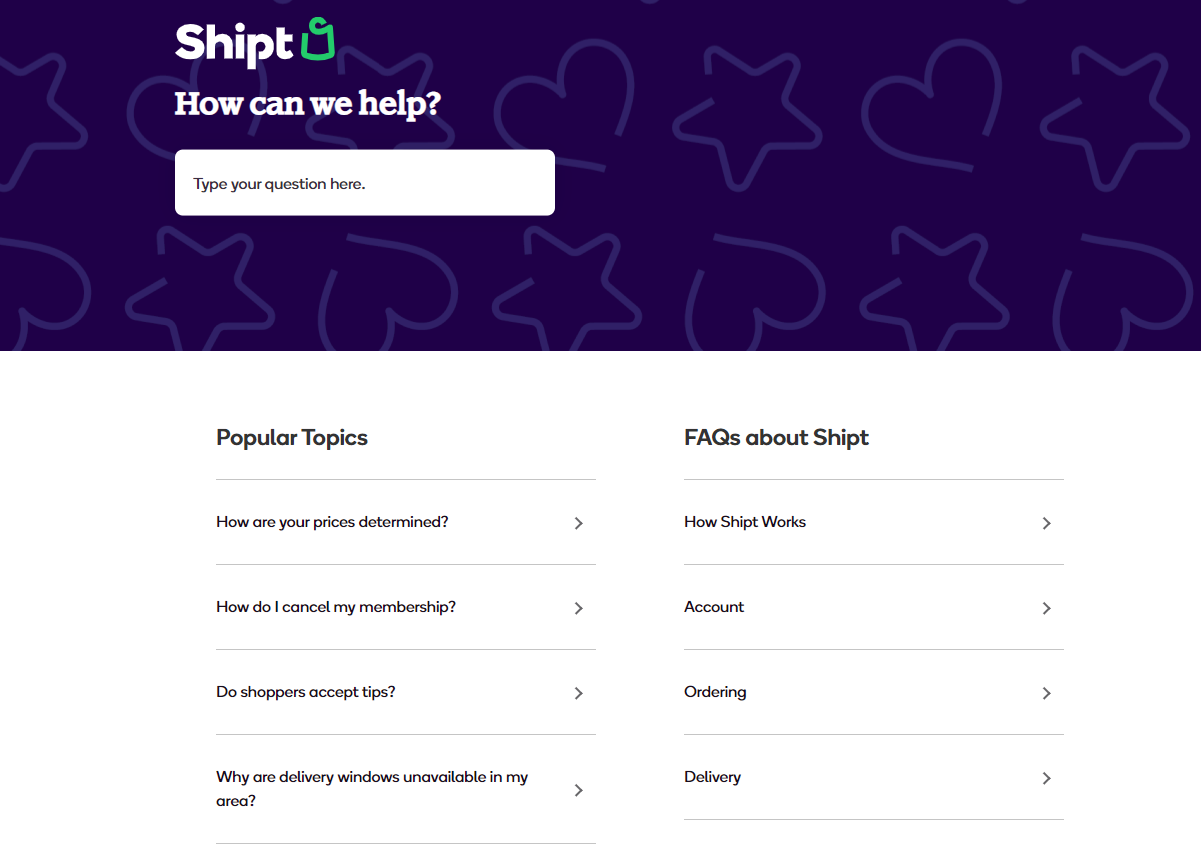

Knowledge bases typically offer self-service portals for members. This 24/7 access to information caters to the modern consumer's desire for instant gratification and empowers members to find answers on their own time.

Ensure Compliance

Credit unions operate in a heavily regulated environment. A knowledge base serves as a single source of truth for all compliance-related information. Updates to policies or procedures can be instantly shared across the organization, ensuring everyone's on the same page when it comes to regulatory requirements.

This centralized approach to compliance information not only reduces risk but also simplifies audits. When regulators come knocking, you can quickly show that all staff have access to the most up-to-date compliance information.

Fostering Collaboration and Knowledge Sharing

Knowledge bases aren't just static repositories; they're living, breathing ecosystems of information. The best knowledge base software encourages collaboration, allowing staff to contribute their expertise, share insights, and collectively build a robust knowledge resource.

This collaboration breaks down silos between departments, encourages cross-functional learning, and ensures that valuable institutional knowledge isn't lost when employees move on.

Common Problems Faced by Credit Unions and How Knowledge Bases Solve Them

From outdated information to knowledge harding, credit unions often face specific challenges that a knowledge base can effectively address. These include:

The SharePoint Struggle: From Complexity to Clarity

Many credit unions have tried to use SharePoint as a makeshift knowledge base, only to find themselves lost in a maze of folders and files. A dedicated knowledge base software offers a more intuitive, searchable interface designed specifically for information and knowledge management.

Outdated Information: Keeping Knowledge Fresh

When it comes to the world of finance, yesterday's information can quickly become today's misinformation. Knowledge-based software often includes features like version control and scheduled review reminders, ensuring your information stays current and reliable.

Verification and Building Trust in Your Content

How do you know if the information you're looking at is the latest and greatest? Knowledge bases solve this with clear authorship, revision histories, and approval workflows. Your team can trust that what they're seeing is verified and up-to-date.

Breaking the Knowledge Hoarding Cycle

When information is hard to find, people tend to download and keep their own copies. This leads to version control nightmares and knowledge hoarding. A centralized, easily accessible knowledge base eliminates the need for personal information stashes, ensuring everyone's working from the same, current information.

Bridging Information Gaps

In many credit unions, knowledge gets trapped in departmental silos. A comprehensive knowledge base breaks down these walls, allowing for cross-departmental information sharing and collaboration.

Practical Use Cases: Knowledge Bases in Action at Credit Unions

Let's explore how a knowledge base can be used to address specific needs within your credit union:

New Employee Onboarding

Imagine a new loan officer joining your team. Instead of spending weeks shadowing colleagues and going over manuals, they can access a structured onboarding path in your knowledge base.

From basic credit union operations to specific loan products and compliance requirements, everything they need is at their fingertips. Interactive quizzes and progress tracking ensure they're absorbing the information, while easy access to FAQs and process guides support them as they start handling member queries.

Product Knowledge Management

Credit unions often have a wide range of products, from basic savings accounts to complex mortgage options. A knowledge base can serve as a comprehensive product catalog, complete with detailed specifications, eligibility criteria, and comparison tools.

When a new product launches or an existing one changes, updates can be instantly pushed out to all staff. This ensures that whether a member is talking to someone in-branch, over the phone, or via chat, they're getting consistent, accurate information.

Compliance and Policy Management

The world of finance has strict regulations and staying compliant is crucial. A knowledge base can serve as a central repository for all compliance-related information. Policy updates, regulatory changes, and compliance training materials can be organized, easily searchable, and always up-to-date. When auditors come calling, you can quickly demonstrate that your team has access to and understands the latest regulatory requirements.

Member Self-Service Portal

Imagine offering your members a secure, easy-to-use portal where they can find answers to common questions, access how-to guides for online banking, and learn about your products and services – all without having to call or visit a branch. A public-facing knowledge base can serve this purpose, reducing the load on your customer service team while providing members with 24/7 access to information. This self-service option not only improves member satisfaction but also frees up your staff to handle more complex queries and build deeper relationships with members.

Change Management and Communication

Credit unions often undergo changes – be it a core system upgrade, a merger, or a new strategic initiative. A knowledge base can be a powerful tool for managing these transitions. Use it to create a centralized hub for all change-related communications, training materials, and FAQs. Staff can access information about upcoming changes, track progress, and provide feedback. This transparent, accessible approach to change management can significantly reduce anxiety and resistance, ensuring smoother transitions and quicker adoption of new processes or systems.

How Credit Unions are Currently Using Knowledge Base Software: Real-World Success Stories

Colorado Credit Union: 75% More Efficient

Colorado Credit Union faced a common challenge: information silos and buried procedures. They turned to Helpjuice for a solution. The result? A centralized knowledge base that has become their "single source of truth."

With powerful search capabilities and easy content management, they've seen a 75% success rate in users finding the information they need – and that's just in the first few months of implementation.

"We’re currently seeing about a 75% success rate when users are looking for a topic, and landing on the answer. This is only in the first couple of months of being live on the platform." - Ryan Chism, VP of IT

Automotive Credit Corporation: 50% Reduction in Answering Questions

Automotive Credit Corporation was grappling with an inefficient question-answering process that was both time-consuming and costly. After implementing Helpjuice, they saw dramatic improvements.

“Helpjuice has helped us to free up significant hours of leadership time by providing easy access to everyday production questions. It has also given us access to unsolicited feedback for our training programs.” - Bob Budiongan, Director of Talent and Organizational Development

The results speak for themselves: a cost savings of at least $350K per year in cost avoidance, improved efficiency, and the ability to quickly update and disseminate information across the organization.

Collins Community Credit Union: Quality Management and Effective Content Creation

For Collins Community Credit Union, the challenge was inconsistent documentation and approval processes. They found that Helpjuice provided the structure they needed. The platform's content management system has allowed them to be more effective in their quality management initiatives.

"The content management system we created using Helpjuice also allows us to be more effective under the ‘quality management’ initiatives we started about 18 months ago." - Richard Thompson, Sr. Project Manager

These success stories highlight the transformative power of a well-implemented knowledge base solution in credit union environments. From improving operational efficiency to enhancing employee onboarding and saving significant costs, the benefits are clear and measurable.

Unlock Your Credit Union's Full Potential With Knowledge Base Software

Remember the chaotic scene we painted at the beginning? The overwhelmed staff, the impatient members, the information scattered to the four winds?

Now, imagine a credit union where information flows freely, where staff exudes confidence, and where members receive swift, accurate responses to their queries.

This is the reality that a knowledge-based solution like Helpjuice can create for your credit union. By centralizing your information, empowering your employees, enhancing member service, ensuring compliance, and fostering collaboration, a knowledge base transforms the way your credit union operates from the ground up.

The challenges faced by credit unions – from information silos to compliance concerns – aren't immovable. They're opportunities for growth, efficiency, and improved member service.

A knowledge base is more than just a software solution; it's a strategic asset that can drive your credit union forward in an increasingly competitive and complex financial landscape.

Stop wrestling with outdated systems, scattered information, and frustrated staff and members. Harness the power of knowledge management and unlock your credit union's full potential.